|

|

|

|

|

|

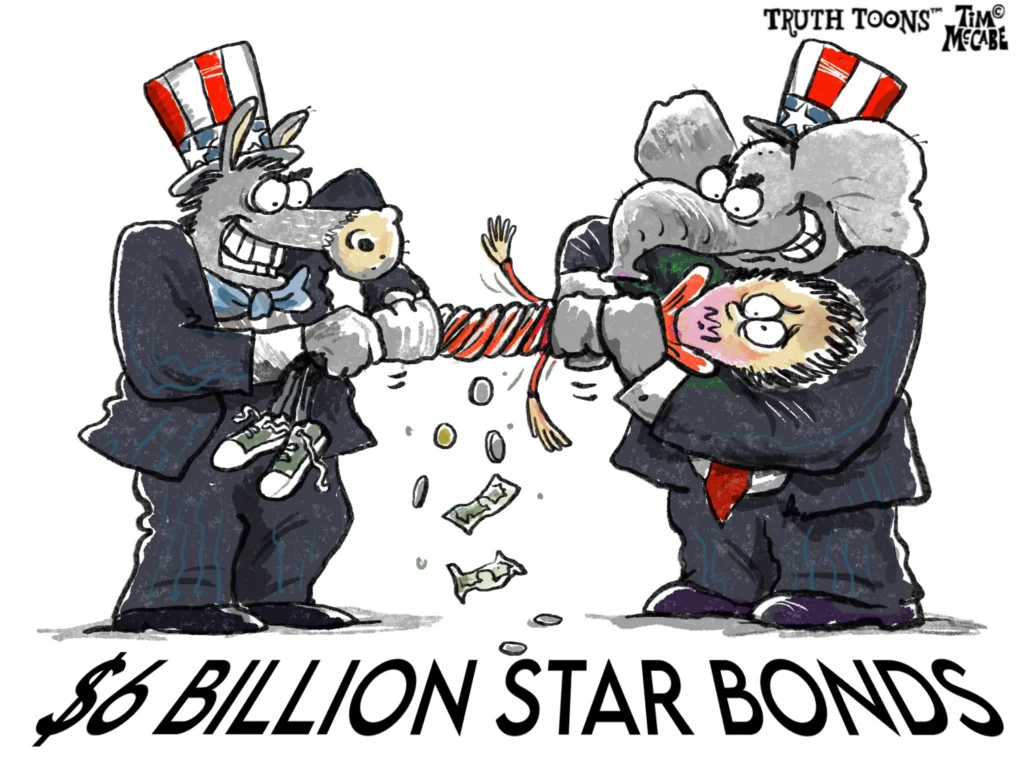

I was not going to write another column about the Chiefs’ Star Bond fiasco, but…the continuing bad news for projects backed by tax incentives in the KC area has compelled me to once again dig into the enormous tax giveaway for the Chiefs. First, we had Platt County pulling out of their deal with Zona Rosa, and second, we have the announcement that Prairie on Fire (I call it Prairie Not on Fire) has defaulted not only on their Star Bond but now has defaulted on a second bond, their CID bond (Community Improvement District). Here is Channel 41’s link to the story: Naturally, the pro Star Bond crowd continues to sing the praises of the Chiefs’ $2.775 billion Star Bond district, which sprawls across at least 293 square miles, taking in the western half of Johnson County and nearly all of Wyandotte County. It’s time for the big boys in Topeka to embrace the free market. Republican leaders, Senate President Ty Masterson (Republican and my opponent) and Speaker of the House Dan Hawkins (Republican), along with Democrat leadership (Democrat Laura Kelly), must stop pretending (or being brain washed) that the only way a project can be successful in Kansas is to load it up with tax incentives. They seem to forget that by diverting tax dollars from public use to the pockets of:

they increase our taxes. AGAIN, tax incentives increase taxes on the rest of us. Oh, one more goody to share. Cooke County and the State of Illinois are turning a cold shoulder to the miracle come-from-behind Chicago Bears’ new stadium proposal, which has a public price tag of $855 million. Compare this to the Chiefs’ $975 million ask just for the practice field and executive offices in Olathe. From PBS, WTTW Chicago: Those infrastructure improvements (for the Bears) could cost $855 million, according to a team consultant. …Illinois Gov. JB Pritzker has previously said he was in support of assisting with infrastructure and roads but would not back a measure that would use state funds to build facilities or protect the team from paying property taxes on the new development. Ok, is Illinois smarter than Kansas on tax incentives??? Note Governor JB Pritzker stated — (he) would not back a measure that would use *state funds to build the facilities or protect the team from paying property taxes on the new development. However, here in Kansas, we’re looking at $2.775 billion of taxpayers’ money to build the Chiefs’ stadium, practice fields and executive offices, which will all be owned by some sort of sports authority (the State of Kansas), thus shielding the Chiefs’ from EVER paying property taxes. Meanwhile the rest of us struggle on…paying OUR property taxes. I need your help in funding this campaign. Kansas is HUGE, and I cannot do this alone. It’s up to you — if you want the status quo to continue of Kansas being the high tax point on the prairie, ignore my plea…or roll up your sleeves, forward my emails, volunteer, and PLEASE consider contributing, yes even if you have already contributed. Thank you all for your SUPPORT!!! Charlotte 💻 Donate online: oharaforkansas.com O’Hara for Kansas With gratitude, |

And the Walls Come Crumbling Down…

Get Involved

Support Charlotte

Charlotte…the continued conservative leadership that Johnson County, KS needs now, more than ever!

I am honored to be running for re-election as Johnson County District 3 Commissioner, and I am committed to continuing to serve our entire community with integrity, dedication, passion and faith. I have consistently advocated for the interests of “We The People.”

Thank you for the honor you have given me to serve and I look forward to visiting with you during my re-election campaign!