|

|

|

|

|

|

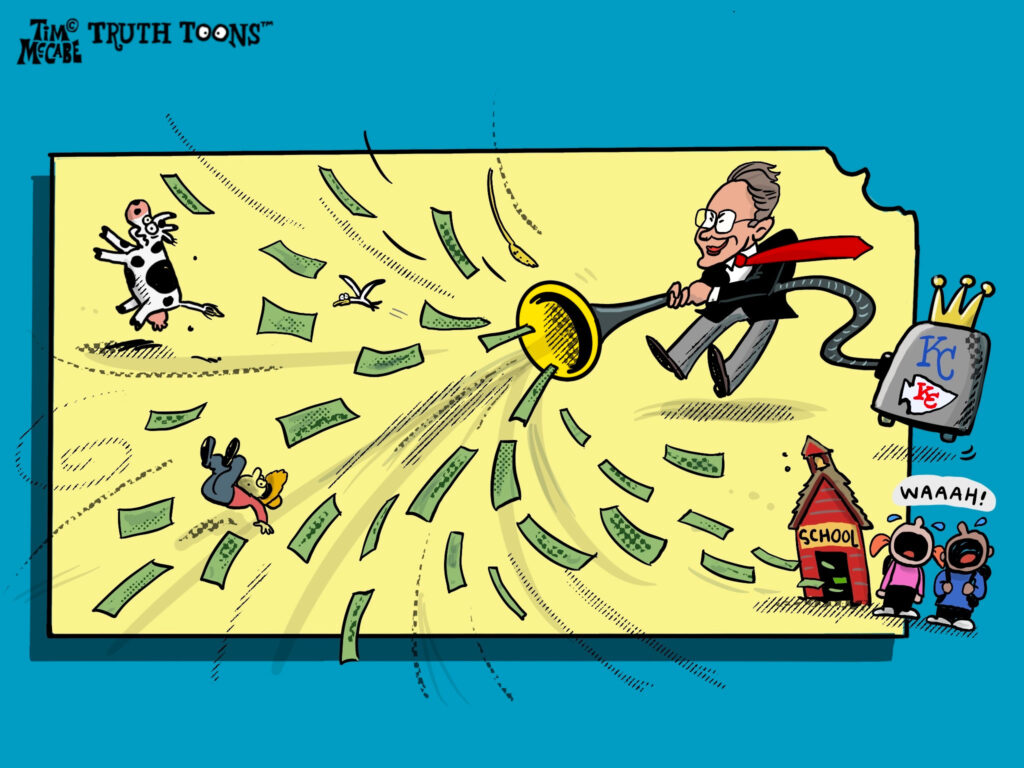

Ah, Johnson County—the engine of Kansas’ economic prosperity. Beautiful suburbs, lush lawns, and schools flush with funding have long been the image. But behind this oasis lies a 40-year heist: economic development schemes, tax incentives, and corporate welfare siphoning tax dollars from the rest of the state. Here’s the twist. After four decades of bleeding the rest of Kansas, even Johnson County’s own residents are waking up. Their pockets are being picked too—through skyrocketing property taxes. Yes, even the well-heeled are rebelling. This rebellion matters. At its core is a broken system that diverts hundreds of millions of dollars each year away from schools, cities, counties, and community colleges, and into the pockets of the politically well-connected. The hard truth: there is no equal protection under Kansas law. Most Kansans must pay their full property taxes, but a chosen few enjoy abatements and incentives, paying pennies on the dollar. For 40 years, Kansans have been told the same story: “These tax incentives will broaden the tax base and eventually lower everyone’s taxes.” The reality? Taxes only go one way—UP. Tax incentives were supposed to help depressed areas of the state. Instead, Johnson County’s wealthy elite—armed with lawyers, accountants, bankers, and compliant local officials—have gamed the system. It’s a reverse Robin Hood scheme, stealing from everyday Kansans to enrich the already prosperous. Just look at the numbers of a few of the sheltered projects:

And what does Western Kansas get? HAD. Wyandotte County and Sedgwick County play their part too, but Johnson County is the undisputed master of the tax incentive scam. The question is simple: Which gubernatorial candidate will fight for equal protection under the law? If you want this taxpayer theft to end, help me spread the word. Tell your family, your friends, and your neighbors why you’re supporting my campaign for governor. And please, consider making a financial contribution today so we can bring this fight statewide. Together, we can stop the bleeding. Charlotte O’Hara |

Johnson County, KS is Doing What to You?

Get Involved

Support Charlotte

Charlotte…the continued conservative leadership that Johnson County, KS needs now, more than ever!

I am honored to be running for re-election as Johnson County District 3 Commissioner, and I am committed to continuing to serve our entire community with integrity, dedication, passion and faith. I have consistently advocated for the interests of “We The People.”

Thank you for the honor you have given me to serve and I look forward to visiting with you during my re-election campaign!